Rubin Report - The Pulse of the NYC Development / Issue No. 14 - February 2024

Rubin Isak

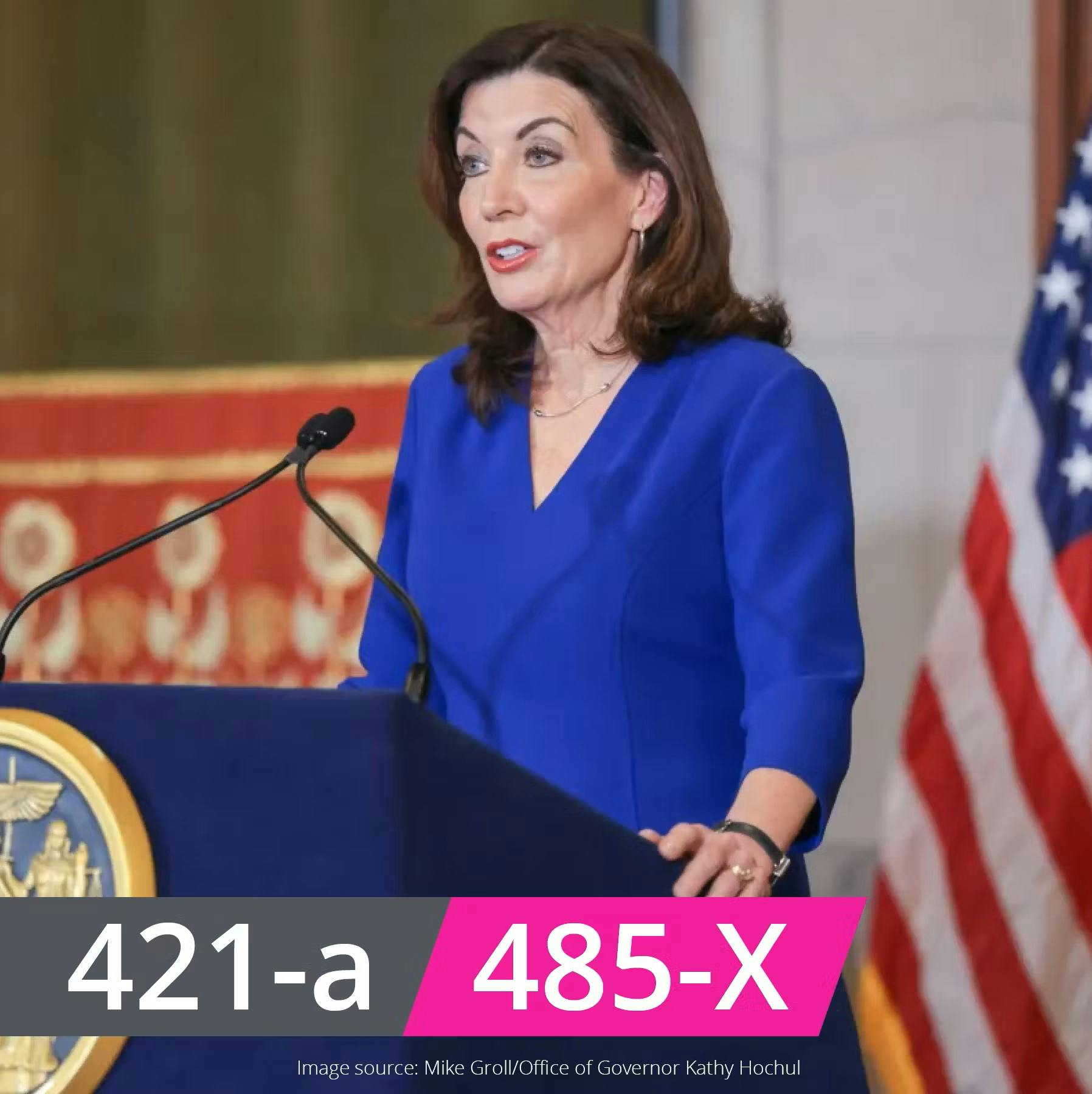

With an April 1st due date looming for the 2025 budget, the NYS senate will be busy debating housing, a tax abatement and “good cause” eviction. This topic is a very contentious one in the senate. If they again fail to pass a 421-a type tax abatement program, my belief is that Governor Hochul will do what she did with Gowanus (which worked) and sign an Executive Order in an effort to create housing. Keeping a close eye on this.

What will you learn about in this months report:

- Governor Hochul just proposed a 421-a replacement, she dubbed 485-x in the FY 2025 New York State Executive Budget. I break it down here.

- The Federal Reserve had their much anticipated meeting: Interest rates will hold steady for now and Fed Chair Powell has stated that the first cuts wont start until the middle of this year. I summarize his interview below.

- Treasury Rates & Mortgage rates have risen since last month. More detail inside.

- Inflation has come down slightly to 3.09%, which is a welcome sign.

- See some of our recent sales and new development sites we just took to the market.

Recently Exclusive Sales:

92 Prospect Park SW, Brooklyn

This ± 5,586 sf vacant lot allows for a ±10,159 sf 6-story residential apartment building. The subject property is a 41.25’ x142.54’ irregular through lot in the R6A/R5B zoning district.

SOLD for $3,500,000 in an all-cash transaction on January 31, 2024

42-24 Crescent Street, LIC

A 45’ x 100’ corner lot, improved by a 7-Story, 80-Room Hotel, delivered vacant in a M1-5/R7-3/LIC zoning district. Allowing a purchaser to convert or keep as existing.

SOLD for $18,000,000 in an all-cash transaction on February 8, 2024

New Manhattan Development Site Exclusive Listings:

307-309 6th Avenue

Development Site Advisors®️ and Verus Real Estate has been exclusively retained by ownership to sell 307-309 Sixth Avenue located in the highly coveted West Village. This represents a rare development opportunity for a mixed-use boutique condominium building in the West Village - one of the most charming neighborhoods in New York City.

The property is currently improved by a 2-story commercial building with 42.81’ of frontage and a total lot size of ±6,774 sf. The approved plan can deliver a 7-story mixed-use building with a total of ±22,347 sf and 16 residential dwelling units.

257-259 Canal Street

Development Site Advisors® has been exclusively retained by ownership to sell 257 - 259 Canal Street, located in the bustling SoHo neighborhood. The property is zoned M1-5/R10 and falls within the Special SoHo/NoHo Mixed Use District, allowing for a development potential of up to 12.00 FAR or ±48,312 ZFA.

The property, which has been under the same ownership for 87 years, currently features a 2-story commercial building with 51.75 feet of frontage and a total lot size of ±4,026sf. This represents a significant development opportunity in one of New York City’s most vibrant neighborhoods.

Financial Market Snapshot:

- Federal Prime Rate: 8.5%

- Secured Overnight Financing Rate (SOFR): 5.31%

- United States Federal Funds Rate: 5.5%

- United States Annual Inflation Rate: 3.09% (down from 3.35% last month)

- US 1-Year Treasury Rate: 4.96% (up from 4.68% this time last month)

- US 10-Year Treasury Rate: 4.27% (up from 3.94% this time last month)

- Treasury Bill Auction Rates:

- 4-Week Term: 5.28%

- 26-Week Term: 5.065%

- Mortgage Rates:

- 30-Year Fixed Rate: 7.13% (up from 6.69% last month)

- 15-Year Fixed Rate: 6.5% (up from 5.95% last month)

- 5-Year Commercial Rate: 6.7% (down from 6.92% last month)

Interest Rate Talk

Powell’s 60Minutes interview takeaways: (click here to watch the full interview)

Q. Is inflation dead?

A. "The job is not done."

Q. Why not cut rates now?

A. "We want to see more evidence that inflation is moving down. Our confidence is rising but we want to have more confidence it's lowering to 2%. We don't need to wait to get to 2% to cut rates. 5.5% rate will remain for 6 months. Not likely to cut in March."

Q. Will the FED cut In May?

A. "We just want to see more good data. And we do expect to see that."

Q. On Commercial Office Buildings & bank exposure: Is this another real estate led banking crisis?

A. "I don't think that's likely. It's a manageable problem."

Q. Is the national debt a danger to the economy in your view?

A. "In the long run the US is on an unsustainable fiscal path."

Summary:

"The first cut will be in the middle of the year."

485-x: The proposed 421-a replacement

Governor Hochul just came out with her proposed 421-a replacement, dubbed 485-x. This would create a 35-year tax break benefit period for developers of rental projects that include affordable units, and 40 years for homeownership projects with affordability.

Click here to read more.