The Rubin Report - The Pulse of the NYC Development / Issue No. 6 - June 2023

Rubin Isak

Good News:

The fed has paused on an increase in the June 14 meeting, the first pause in 15-months. The interest rate increases have actually worked to tame and bring down inflation. The US inflation rate is now at 4.05%, down from 4.93% last month. When the fed started increasing rates in March of last year, the inflation rate was 8.54% and the fed benchmark rate was 0.25% to 0.50%. Inflation hit a high of 9.06%, in June 2022, a number we have not seen in over four decades (1982) when the inflation rate hit 10.33%.

Pay attention:

The fed also made some very interesting comments on the future of interest rates. They forecast that the federal funds rates will be increased to 5.6% by the end of this year (which means at least two more 0.25% increases are on the horizon for the July and September meetings). They then project that the rate will drop to 4.6% next year in 2024 and by 2025 rates will decrease further to 3.4%

While the current higher rates will impact mortgage rates and make refinancing and attaining new debt more expensive, remember this is temporary. Markets are cyclical, and we are towards the bottom end of this current cycle.

In 421-a news:

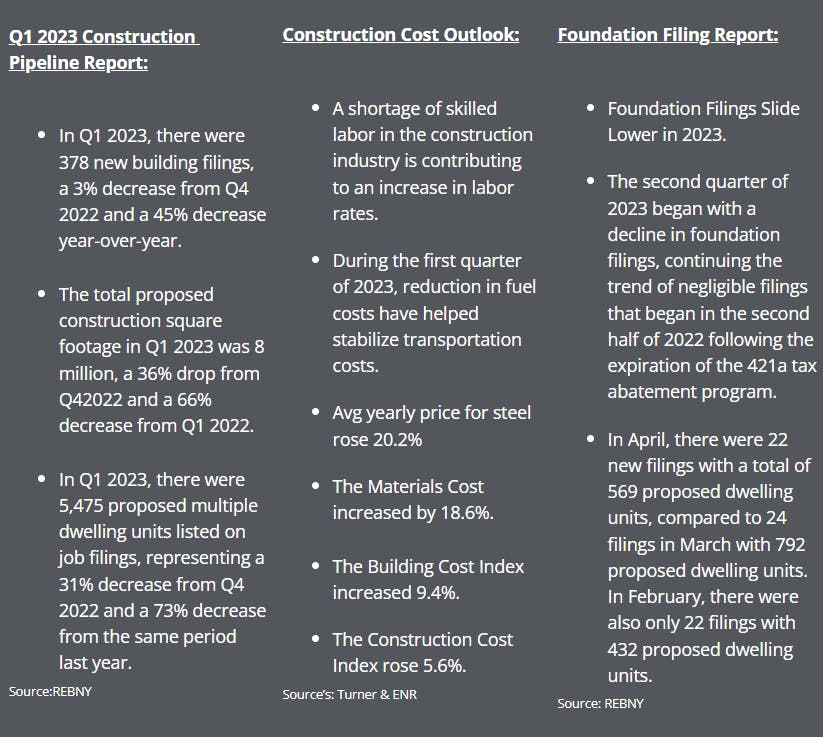

Unfortunately the state legislature and Gov. Kathy Hochul failed to come to terms on a housing deal or even an extension to the 421-a construction deadline (where a developer must finish a project by June 2026 to qualify for 421-a even if they met the June 2022 deadline). Without this much needed legislation, thousands upon thousands of rental units simply cannot and will not be built.

Properties located in proven condominium markets will be the market movers for ground-up development for the foreseeable future.

2023 NYC Development Site Market Snapshot:

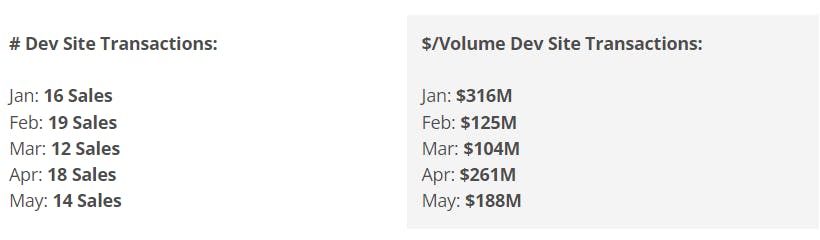

From January 1 to May 31 of this year we have seen 79 development site transactions valued at $994 Million. This represents a -16.8% drop in transaction volume and a -44.7% drop in dollar volume over the same period last year. The overall NYC commercial real estate sector has seen 852 transactions valued at $10billion, which is a -36% drop in transaction volume and a -34% in dollar volume over the same time last year.

Market Report’s Overview:

Financial Market Summary:

- The Federal Prime Rate holds steady at 8.25%.

- The Secured Overnight Financing Rate (SOFR) is now at 5.05% up from 4.8% one month ago.

- The United Stated Federal Funds Rate holds at at 5.25%

- United States Annual Inflation Rate: The current inflation rate is now at 4.05%, down from 4.93% last month. The Fed’s stated goal is to steadily raise rates until they are able to achieve a 2% inflation rate.

- The US 1-Year Treasury Rate is now at 5.2%. Last month it was at 4.89%.

- The US 10-Year Treasury Rate is holding steady at 3.84%.

- Mortgage Rates: the 30-Year Fixed Rate is now at 6.95%, up from 6.43% a month ago and the 15-Year Fixed Rate is 6.32%, also up from last months 5.9%.